26th April 2019

Outside Fortress Europe Excerpts

This Global Business Strategy Blog post is based upon unabridged excerpts from Chapter Nine, Acquisitions, Joint Ventures and Strategic Alliances in Global Business Strategy, in Outside Fortress Europe: Strategies for the Global Market.

Context References

Armstrong, A. (2019, 26 February). Will Waitrose be left on the shelf by Ocado’s deal with Marks & Spencer? telegraph.co.uk.

Economist. (2019, March 16th). The end of the affair: How to prevent business break-ups – or end them amicably. The Economist, 68.

Economist. (2019, February 16th). Entente non-cordiale: The Renault-Nissan alliance and its former chief are still in limbo. The Economist, 64-65.

Eley, J., & Pooley, C. R. (2019, February 26). Ocado and M&S in talks over UK retail joint venture: High street chain has lagged behind rivals in grocery delivery. ft.com.

Hille, K. (2019, 25 April). Growth test looms for Foxconn after chairman’s departure: Global smartphone slowdown highlights Apple supplier’s failure to diversify beyond IT. Financial Times, p. 16.

Inagaki, K., & Shrikanth, S. (2019, 25 April). Nissan slashes profit guidance by 22%: Sales pressures in wake of Ghosn’s ousting put clout in Renault alliance at risk. Financial Times, p. 14.

Jolly, J., & McCurry, J. (2019, 3 April). Renault accuses Carlos Ghosn of violating company ethics: Investigation into former boss found ‘questionable practices’, French carmaker says. theguardian.com.

Neate, R. (2019, 27 February). M&S agrees £750m food delivery deal with Ocado: Marks & Spencer will buy 50% stake and take its food offerings online for first time. theguardian.com.

Reuters. (2019). Nissan, Renault and Mitsubishi pledge new start: Carmakers’ alliance breaks up all-powerful chairmanship previously occupied by Carlos Ghosn. theguardian.com, p. 12 March.

Vincent, M. (2019, February 26). A late M&S move into online food would deliver far more to Ocado: Chain’s shareholders may be the ones left with indigestion if a retail joint venture deal is made. ft.com.

Wood, Z. (2019, 27 January). Ocado’s secret talks with M&S could spell the end for Waitrose tie-up: Talks to deliver Marks & Spencer groceries emerge as end to Waitrose tie-up. theguardian.com.

Outside Fortress Europe Excerpt

Introduction: Network routes to serving foreign markets

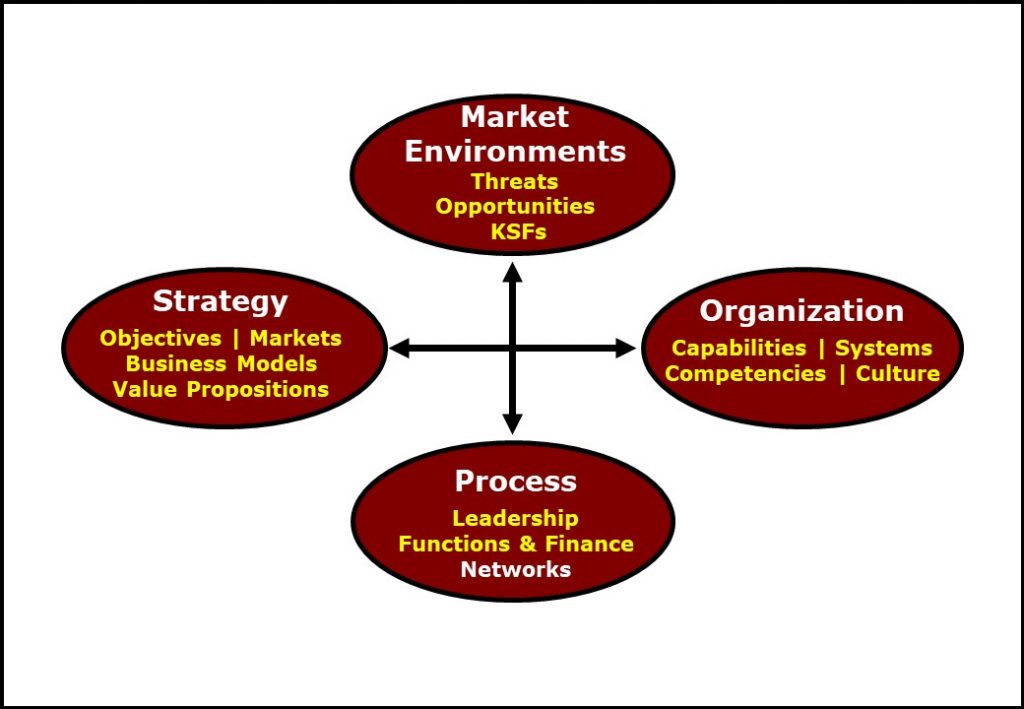

Figure 1 revisits the graphic which framed the discussion of the four key dimensions of global business strategy we introduced towards the end of Chapter One (see The Global Business Strategy Album post The dimensions of global business strategy), in this context highlighting Networks as one approach to managing the complex alignment of organization and global business strategy with reference to international market environments.

In Chapter Seven, we briefly discussed the various market entry modes firms can incorporate into their global business strategy design. In the teaching of international business this is typically described as selecting from the variety of routes to serving foreign markets which are available to the internationalizing company, also frequently described in textbooks as ‘market entry mode’. We provided the following categories by way of example:

-

-

- Franchising.

- Licensing.

- Contract manufacture (OEM etc.).

- Strategic alliances.

- International joint ventures.

-

As we will see in the following sections, Networks (of organizations) have come to play a major role in the conduct of global business strategy. Many definitional problems are associated with the term networks but, in their broadest sense, they describe inter– rather than intra-organizational solutions to coping with the dynamics and complexity of the business environment.

In Chapter Ten, Theories of Organizational Behaviour and Strategic Management, we introduce the seminal work of economist Oscar Williamson (1975), focussing in particular on his propositions regarding the alternative transaction mechanisms of markets versus hierarchies, i.e. addressing the question relating to whether a company should operate business processes internally or engage with the volatilities and uncertainties of external markets.

Networks provide an intermediate solution to the Williamson question. They can offset the uncertainties associated with market-based transactions and avoid the complexities of integration. They are not without their problems and there are strong criticisms of their existence. A neo-classical critique, for example, would argue that collaboration rather than competition will stifle innovation and allow companies to become inefficient, the customer being the ultimate victim of cartel-like business practices.

Organizational theorists will point to the challenging task of managing within organizations, let alone between them. Despite this, there is growing evidence that network solutions can provide extraordinary competitive advantages, whether this be through the giant Japanese keiretsu networks or amongst the exporting networks of SME Scandinavian producers (see below) or the remarkable success story of alliances such as that between Apple and its Taiwanese (outsourced) manufacturing partner Foxconn. In the following sections, we explore the network phenomenon, charting its incidence and evaluating its impact on global strategic management theory and practice, and we do so with reference to alternative strategic options available to companies, most notably organic growth and a further assessment of merger and acquisition (M&A) activities.

(In this GBS Blog post we don’t address global business strategy via M&A. For insights, please see The Global Business Strategy Album post: Deutsche Bank & Commerzebank: What explains the urge to merge?).

Collaboration for competitive edge

For a broad range of reasons many firms are seeking ‘strategic partners’ to cope with the risks and uncertainties of the contemporary global business environment (see, for example, Christofferson, 2013, for a comprehensive review of the antecedents leading to the growth in international strategic alliances in recent years). Insead professor Yves Doz and his colleagues have provided deep insights into collaborative competitive strategies through examining the role of partnerships and alliances within the broader context of global strategic management (e.g. Doz and Hamel, 1998) and we draw heavily on the frameworks and concepts this research has produced in the sections which follow, updating the research evidence and providing contemporary practical examples in the process.

While alliances of some sort emerge as an obvious solution to what often appear to be otherwise intractable problems, it remains extremely difficult to evaluate their effectiveness as an approach to global strategic management. As with many management issues the immediate problem is definitional. In practice, there are a variety of inter-organizational forms including international coalitions, strategic networks, consortia, hybrid organizational arrangements and industrial systems ‘constellations’.

As a general observation, effective strategic alliances are a particular mode of inter-organizational relationship in which the partners make substantial investments in developing common operations in a long-term collaborative effort. For the most part, strategic alliances are not temporary or short-term phenomena. Rather, they involve a substantial commitment of resources, the creation of mutually acceptable objectives and a sharing of risk from environmental pressures. For a comprehensive, longitudinal assessment of the nature and role of strategic alliances in business strategy, see ‘A 22-year review of strategic alliance research in the leading management journals’ by Gomes et al. (2016).

In the debate on definitions, strategic alliances are typically placed on a continuum that measures the degree of integration on a scale running from ‘free markets’ to ‘internalised hierarchy’. One side of the continuum represents a situation characterised by the complete integration of activities within the collaborating organizations, typically in the form of a distinct legal entity (e.g. Renault-Nissan).

Moving towards the other side of the continuum suggests ever-lower degrees of integration to an extreme where all transactions are undertaken in an open market context. In addition to the degree of integration, it is also useful to define alliances by the degree of mutual interdependence which exists between the organizations in the relationship.

Most writers on the subject argue strongly that it makes strategic sense to create an alliance that is based on compatibility and that a key operational imperative is to recognise the need to develop mutual trust and confidence between the parties involved. Despite this apparently obvious logic, there remains the problem of contrasting perceptions of the true nature of the relationship since each partner can view the alliance from a distinctive perspective and frequently does so, an ambiguity that must be carefully managed (Kumar, 2014). This explains why strategic alliances are extremely difficult for academics or business managers to define with any precision: gaining a common viewpoint on the degree of integration and dependence is very difficult to achieve in both theory and practice. Addressing this definitional conundrum alongside determining those factors which contribute to successful strategic alliances in global strategic management provides the principal focus of this chapter.

Mapping strategic alliance activity

There are several general drivers in the global economy that encourage firms to co-operate rather than follow the ‘compete at all cost’ philosophy. These include:

-

-

- Increased competitive pressure in the globalization process and the strategic need to gain scale and scope economies.

- The need to preserve strength in national markets while adapting to the local needs and demands of international markets.

- Technology and knowledge transfer flows at ever-increasing rates, in the process shortening product life cycles and forcing the need to share R&D activities between companies and countries (Contractor and Woodley, 2015).

- Sophisticated consumers are demanding more and more specialised value propositions, thus creating a supply-side need to combine the best technology with the best marketing (e.g. Sony Ericsson, wherein Sony got access to world-leading cellular technology and the relatively unknown Ericsson gained access to Sony’s global consumer electronics distribution network and brand recognition.

- Excess capacity in traditional industries has led to many businesses repositioning in new markets and seeking partners to aid the transition, e.g. VW in China (Frynas and Mellahi, 2014).

- Many groups have become over-diversified, thus forcing a need to restructure.

- Threats of take-over or successfully completed take-overs have forced industrial restructuring.

-

Whatever the motivations underpinning network arrangements, it is important for ‘parent’ companies to decide how much input of either organizational resource (people, funds, technology) or strategic resource (ideas, markets, partnerships) to put into the alliance (see Pisano and Verganti, 2008, for helpful guidance). Similarly, a decision must be made on the retrieval of output from the strategic alliance, e.g. to take all the cash/profit earned by the alliance or to leave it within the venture so that the ‘child’ can reinvest and grow, similar to a company financing its growth from retained earnings.

In an influential book that reviewed the burgeoning role of alliances in global strategic management Lorange and Roos (1992) stress that it is the JV parents’ perspectives regarding strategic positioning as well as the input/output of resources that dictates the form of the strategic alliance. This emphasises the fundamental fact that strategic alliances are in many cases a means to an end, not the end itself. Considering the ‘means-to-an-end’ hypothesis, McKinsey’s Bleeke and Ernst (1993) in their well-received practitioner-focused book (which also covered acquisitions in global business strategy) saw the emergence of alliances as a direct result of companies avoiding the Darwinian game:

In businesses as diverse as pharmaceuticals, jet engines, banking, and information technology, managers have learned that fighting long, head-to-head battles leaves their companies financially exhausted, intellectually depleted, and vulnerable to the next wave of competition and innovation.

For the McKinsey authors, then, turbulent business environments have led to “the death of the predator”, with large multinational corporations delivering better value to their stakeholders, including shareholders, employees and customers, by selective sharing and/or exchanging control, costs, market access, knowledge and technology rather than “competing blindly” in open markets. Indeed, they argued that the strongest predictor of a company’s success in global business strategy is its willingness and ability to collaborate. As with many ground-breaking contributions to the management literature, the prescience of the Lorange & Roos and Bleeke & Ernst publications spawned new directions in strategic alliance research, much of which we cover in this chapter.

Entente cordiale

Another McKinsey consultant, the renowned Japanese strategic thinker Kenichi Ohmae, provided a similar logic in his prediction relating to the growing incidence of strategic alliances in the context of the internalization of companies and the globalization of markets:

Globalization mandates alliances, makes them absolutely essential to strategy. Uncomfortable, perhaps – but that’s the way it is. Like it or not, the simultaneous developments that go under the name of globalization make alliances – entente – necessary.

Building on his ‘Triad Power’ thesis (ASPAC/Europe/Americas), Ohmae saw three key drivers within the globalization process (defined as the globalization of markets, industries and companies) which are making alliances a prerequisite for corporate survival.

First, “the Californization of need”, the phenomenon which sees a convergence of customer needs and preferences, particularly with reference to consumers purchasing the best products available and having the ability to make such well-informed decisions (see the discussion relating to Standardisation and/or Adaptation of the Strategic Marketing Mix in Chapter Six). Today this trend is facilitated by the proliferation of communication channels and the knowledgeable consumer empowered by universal internet access. As we explained in Chapter Four, Theories of Strategy and Competition, given choice, customers exercise it. Furthermore, as you raise customer satisfaction you raise their expectations too, in the process forcing an endless pursuit of innovation in the supply base. Ohmae has been heavily critiqued for one dimension of this category: the implicit assumption that customer needs were globally homogenous. We cover this debate in Chapter Six of this book.

(The issue of lifestyle versus demographic factors in market segmentation is addressed in the following Global Business Strategy Album post: Millennials are so passé. And irrelevant for global marketing strategy design).

Second, technology has spread rapidly, dispersing so widely that few companies can single-handedly maintain a leading-edge sophistication, nor can any individual organization be a master in all the technologies which make up today’s complex products. In this sense, globalization marks the death of the fully integrated company, technological pressures forcing ever-increasing levels of ‘outsourcing’. As Ohmae notes:

Nothing stays proprietary for long. And no one player can master everything. Thus, operating globally means operating with partners – and that in turn means a further spread of technology.

Third, the huge fixed cost implications of participation in global markets. Ohmae argues that it is no longer possible for individual companies to build multiple entry barriers around the broad variety of capabilities and competencies required for competitive success. The capital intensity of production which is a distinguishing characteristic of global industries has eroded the variable-cost solution to global business strategy, forcing companies to maximise marginal contribution to a high base of fixed costs.

In combination, these three key globalization drivers are creating a competitive dynamic that is forcing companies to think and behave differently. Ohmae does not ignore the traditional options of organic development or acquisition but he does question their appropriateness as strategic options in all situations: “Experience shows … that you should look hard – and early – at forging alliances. In a world of imperfect options, they are often the fastest and most profitable way to go global”.

It should be noted that Ohmae here refers to alliances, eschewing equity-based joint ventures as relationships riddled with the poisonous desire and imperialistic instinct of the parent companies to gain control (for example, both of the previously mentioned engagements between Sony Ericsson and Philips-LG had relatively unhappy endings). For Ohmae, the only objective for an alliance should be to maximise contribution to fixed costs, a goal achieved by joint exploitation of assets that bring the venture closer to meeting customer needs. While he acknowledges that some joint ventures do succeed he sees within them an inherent instability.

First, the contracts which underpin joint ventures are typically created for a particular set of business environment conditions. When these inevitably change, and the joint venture performance suffers, the original contract then becomes a club to bludgeon and blame, and trust between partners is undermined.

Second, parent companies tend to stifle the aspirations of their joint venture child, especially with regard to its growth ambitions and even more so if these aspirations encroach on their own product/market territory, whether this is by design (deliberate choice) or chance (emergent luck).

In the absence of the control offered by equity-based contracts, Ohmae promotes the logic of entente for alliances, the nurturing of a friendly agreement based on an understanding of mutual benefit. He acknowledges the operational difficulties involved, most notably the fact that many executives equate management with total control and, since alliances involve ceding control, ‘management’ and ‘alliance’ are mutually exclusive. This, notes Ohmae, misses a fundamental fact of capitalist life, particularly in turbulent business environments:

… few businesses succeed because of control. Most make it because of motivation, entrepreneurship, customer relationships, creativity, persistence, and attention to the ‘softer’ aspects of organization, such as values and skills.

Ohmae presents a powerful thesis. It is grounded in the well-established context of the globalization of the world economy and it directly addresses the potentials and pitfalls loitering in and around the global ambitions of large multi-national companies. He is suitably critical of the short-termism which is characteristic of many equity-based ventures and he appropriately lambastes the obsession with ROI measurement criteria, claiming that it de-motivates alliance managers and ignores valuable but hidden contributions to fixed costs. Like his McKinsey colleagues Bleeke and Ernst, he sees alliance formation and exploitation as a fast and flexible response to a turbulent global business environment, an organic organizational form co-existing between mechanistic monoliths (see Chapter Eleven, A Strategic Perspective on Managing Change, for insights relating to market environments and organizational design, including the management of the complexities associated with inter-organizational arrangements such as strategic alliances).

What makes strategic alliances successful?

Many success factors have been established by academics observing alliances and monitoring their performance outcomes (e.g. Doz and Hamel, 1998; Luo and Park, 2004; Palmatier et al., 2007; Rahman and Korn, 2014; Kauppilia, 2015; Niesten and Jolinik, 2015). We categorise these under six broad headings.

-

- Strategic Issues. The strategic interest of each partner toward the alliance, the continued complementarity of their contributions and the ongoing compatibility of their objectives and success criteria are important variables for ensuring success. Alliance stability appears to arise where there is open access to each partner’s skills and there are only limited perceptions of encroachment risk; it is enhanced where there is a strong dependence on the partnership output for independent operations of the alliance members. Strategic compatibility comes about through carefully delineating the boundaries and scope of the partnership.

- Learning and Convergence. Mutual trust and knowledge must be the perennial focus of the partners and this can only occur through a process of continuous interaction (Boersma et al., 2003), especially when the alliance is not meeting its original aspirations and is underperforming in general (Patzelt and Shepherd, 2008). This usually requires a distinction between the negotiating and operating teams in order to avoid having what Doz describes as “concerns, fears and stereotypes” triggered by an adversarial negotiation process transferred into the post-alliance collaboration. This convergence process is enhanced by an early start at understanding each other’s culture and organizational language which, in turn, enhances the ability to communicate and helps avoid ambiguities. Special, cross-disciplinary task forces, off-site workshops and joint projects can foster the two-way communications process essential for success. In addition, each partner must understand the time horizon and diversity of each other’s culture. Companies with short-term capital repayment strategies will be inappropriate partners for an alliance that has longer-term market-share building objectives (a factor contributing to the breakdown in the Philips/LG joint venture in flat panel displays). Similarly, the speed with which each partner identifies, communicates and solves problems is critical to avoid alliance failure.

- Expectation-adjustment Process. Managerial expectations can quickly collapse if negotiations contain over-escalated projections. The reality is frequently different from the image portrayed, creating the familiar problem of dissonance, particularly where cross-cultural perspectives on the ‘negotiated order’ cloud partner perceptions (see Rao and Schmidt, 1998). Furthermore, additional and often unforeseen resources are frequently required before payoffs from the alliance can be gained. Pressure for quick success must be avoided, especially if the strategic alliance begins from a precarious strategic position (e.g. restructuring or crisis). An ability to re-evaluate and reassess the relationship frequently and without trauma is one great facilitator of success but only where openness and frankness provide the foundations of effective communications. Unfortunately, many operating managers conversant with the opportunities and problems of the strategic alliance are also likely to have a stake in its success. This may lead them to deny crises and cover up problems, stressing the positives and suffering from “role constrained” learning with all its negative consequences (Levitt & March, 1988). A final success factor in this category relates to situations where the strategic alliance has been managed as an evolutionary relationship that is receptive to adjustment and revision.

- Governance Process. Success is a function of the match between the characterisation of operations and the way in which they are governed. For example, if the task of the strategic alliance is predictable, if it does not involve too much interdependence and if it does not require task-autonomous decisions then a contracted arrangement is sufficient. Unpredictability and interdependence, however, typically require some equity arrangement in a joint venture to ensure stability in the relationship.

- Capability Transfer Process. It is important that sufficient skills are transferred to support the task of the strategic alliance, especially where multiple partners are engaged in an “innovation ecosystem” (Davis, 2016). Despite this, it is essential to maintain an ‘exclusivity’ clause around each partner’s key skills to prevent erosion of the complementary and unique skills which each party brings to the arrangement. The solution must be organizational as well as analytical. The latter can be achieved by clarity of scope and intent and carefully articulated valuation criteria and management structures. The former must be done through people at the operating level. Such boundaries are often built in more subtle ways (e.g. ‘quiet’ indoctrination). In hi-tech alliances, for example, it is essential that R&D specialists know the boundaries of knowledge that they must preserve, and executives should be aware of “language friction” potential ahead of cross-border partner selection (Joshi and Lahiri, 2015). For example, there is a delicate nuance lurking beneath the words ‘share’ and ‘steal’ when entered into Google Translate™.

- Top-management Monitoring. Strategic alliances are not a cost-free alternative to organic development or acquisitions (see David and Han, 2004, for a broader discussion of strategic choice with reference to the complexities associated with transaction cost economics). Alliances incur a different mix of costs, benefits and risks that have inherently different trade-offs. They may decrease the risk of being wrong (for example, regarding an acquisition decision) but only at a great managerial cost. Alliances require constant managerial attention and persistent efforts to construct genuine value; this, in turn, demands board-level scrutiny, particularly for equity-based full-blown international joint ventures (Reuer et al., 2014). Short-run risks are likely to be lower, but it must be acknowledged that risks tend to increase in the long run as a consequence of the higher likelihood of strategic divergence of the parent companies of the joint venture child over time.

A crude but concise summary for strategic alliance success is contained within the widely disseminated ‘6Cs’ mnemonic:

-

-

- Clarity of purpose, processes and roles.

- Commitment of managerial effort and resources.

- Collaboration on vision, objectives and goods.

- Culture in understanding rationality’s, styles and intellects.

- Control of direction versus autonomy.

- Contingency of actions, adaptations and exits.

-

The evidence on strategic alliance success remains patchy but it is a widely held view that, despite the logic underpinning the adoption of ‘network solutions’ to address global business strategy challenges, many do in fact end up in failure.

This paradox of hope versus experience explains the clamour amongst academics for discovery and scholarly insights into the crux of the dilemma (see, for example, Contractor, 2005; Schilke and Goerzen, 2010; Meier, 2011; Contractor and Reuer, 2014; Majchrzak, et al., 2014; Bengstsson and Raza-Ullah, 2016; Dorn et al., 2016; Ghosh et al., 2016; López-Duartea, et al., 2016; Rai, 2016).

A summary list of reasons for failure explains why alliances are certainly not an easy strategic option and definitely not a ‘quick fix’ solution to structural strategic problems:

-

-

- Failure by either partner to give up autonomy.

- Failure by alliance partners and their management teams to maintain the initial energy put into the start-up negotiations when the more mundane operations phase is enacted.

- A tendency to focus too much internally on making the alliance work at the expense of monitoring the external environment and the original alliance purpose.

- Too much petty politics.

- Failure to develop the critical willingness to learn from partners.

- Too much dependence on a few individuals.

- Failure to maintain a strong ‘black box’ of crucial strengths away from partners.

-

Concluding remarks

Network solutions are a much larger ongoing dimension of international business economic activity as compared to the one-off (or one-at-a-time) internationalization strategies via M&A. The world’s number one brand, Apple, derives much of its enterprise value from the sweat and toil of its strategic alliance (Contract Manufacturer) partner Foxconn; Coca-Cola relies heavily on its business partners, independent bottlers, for its income in what is probably the world’s biggest single Licensing arrangement. A significant percentage of BP-branded petrol stations worldwide are operated by Franchisees; ditto Marriot hotels, McDonald’s restaurants, Starbuck’s coffeehouses and the global mechanic’s favourite, Snap-on workshop tools.

Well-managed strategic alliances which bring together complementary assets and competencies (e.g. Snap-on and its franchisees which combines global presence with local market capabilities) typically have a more enduring lifespan than equity-based joint ventures such as that between Philips and LG Display which brought substitutable assets and diverging parent company ambitions:

With regard to ‘real world’ experiences of international joint ventures and strategic alliances, we can cite an ancient Chinese proverb to explain their potentially fragile nature: same bed, different dreams.

Recommended resources for further inquiry

For readers interested in a more detailed exploration of the subject of strategic alliances, the author’s recommended textbook, based upon the multiple criteria introduced in the ‘Introduction to the Global Business Strategy Blog’ and extracted here is: Tjemkes et al. (2017), Strategic Alliance Management. As its title suggests, this book focuses upon the specific managerial challenges encountered with alliances and it offers an academically robust and practicable eight-stage ‘alliance management framework’ to address them.

In this chapter, we have observed that many strategic alliances created in the spirit of entente collapse for the sake of self-interest, the latter motivation being a key aspect of game theory as eloquently and memorably elaborated by Nalebuff and Brandenburger (2002) in their amusing and thought-provoking book, ‘Co-opetition’. It has unusual ‘subtitles’, claiming in a numbered list that the book evokes: (i) A revolutionary mindset that combines competition and cooperation; and explains (ii) The Game Theory strategy that’s changing the game of business.

Outside Fortress Europe Extract References

Bengstsson, M., & Raza-Ullah, T. (2016). A systematic review of research on cooperation: Toward a multilevel understanding. Industrial Marketing Management, 57, 23-39.

Bleeke, J., & Ernst, D. (1993). Collaborating to Compete: Using Strategic Alliances and Acquisitions in the Global Market Place. New York: John Wiley & Sons.

Boersma, M. F., Buckley, P. J., & Ghauri, P. N. (2003). Trust in international joint venture relationships. Journal of Business Research, 56, 1031-1042.

Christoffersen, J. (2013). A review of antecedents of international strategic alliance performance: synthesised evidence and new directions for core constructs. International Journal of Management Reviews, 15, 66-85.

Contractor, F. J. (2005). Alliance structure and process: Will the two research streams ever meet in alliance research? European Management Review, 2, 123-129.

Contractor, F. J., & Reuer, J. (2014). Structuring and governing alliances: New directions for research. Global Strategy Journal, 4, 241-256.

Contractor, F. J., & Woodley, J. A. (2015). How the alliance pie is split: Value appropriation by each partner in cross-border technology transfer alliances. Journal of World Business, 50, 535-547.

David, R. J., & Han, S. K. (2004). A systematic assessment of the empirical support for transaction cost economics. Strategic Management Journal, 25, 39-58.

Davis, J. P. (2016). The group dynamics of inter-organizational relationships: Collaborating with multiple partners in innovation ecosystems. Administrative Science Quarterly, 61(4), 621-661.

Dorn, S., Schweiger, B., & Albers, S. (2016). Levels, phases, and themes of coopetition: A systematic literature review and research agenda. European Management Journal, 34, 484-500.

Doz, Y. L., & Hamel, G. (1998). Alliance Advantage: The Art of Creating Value Through Partnering. Boston, MA: Harvard Business School Press.

Frynas, J. G., & Mellahi, K. (2014). Global Strategic Management (3 ed.). Oxford: Oxford University Press.

Ghosh, A., Ranganathan, R., & Rosenkopf, L. (2016). The impact of context and model choice on the determinants of strategic alliance formation: Evidence from a staged replication study. Strategic Management Journal, 37, 2224-2231.

Gomes, E., Barnes, B. R., & Mahmood, T. (2016). A 22-year review of strategic alliance research in the leading management journals. International Business Review, 25, 15-27.

Joshi, A. M., & Lahiri, N. (2015). Language friction and partner selection in cross-border R&D alliance formation. Journal of International Business Studies, 46(123-152).

Kauppila, O. P. (2015). Alliance management, capability and firm performance: Using resource-based theory to look inside the process black box. Long Range Planning, 48, 151-167.

Kumar, R. (2014). Managing ambiguity in strategic alliances. California Management Review, 56(4), 82-102.

Levitt, B., & March, J. G. (1988). Organizational Learning. Annual Review of Sociology, 14, 319-340.

López-Duartea, C., González-Loureirob, M., Vidal-Suáreza, M. M., & González-Díazza, B. (2016). International strategic alliances and national culture: Mapping the field and developing a research agenda. Journal of World Business, 51, 511-524.

Lorange, P., & Roos, J. (1992). Strategic Alliances: Formation, Implementation and Evolution. Oxford: Blackwell.

Luo, Y. D., & Park, S. H. (2004). Multiparty cooperation and performance in international equity joint ventures. Journal of International Business Studies, 35, 142-160.

Majchrzak, A., Jarvenpaa, S. L., & Bagherzadeh, M. (2014). A review of inter-organizational collaboration dynamics. Journal of Management, 41, 1338-1360.

Meier, M. (2011). Knowledge management in strategic alliances: A review of empirical evidence. International Journal of Management Reviews, 13, 1-23.

Nalebuff, B. J., & Brandenburger, A., M. (2002). Co-opetition. London: Profile Books.

Niesten, E., & Jolink, A. (2015). The impact of alliance management capabilities on alliance attributes and performance: A literature review. International Journal of Management Reviews, 17, 69-100.

Palmatier, R. W., Dant, R. R., & Grewal, D. (2007). A comparative longitudinal analysis of theoretical perspectives of inter-organizational relationship performance. Journal of Marketing, 71, 172-194.

Patzelt, H., & Shepherd, D. A. (2008). The decision to persist with underperforming alliances: The role of trust and control. Journal of Management Studies, 45, 1217-1243.

Pisano, G., & Verganti, R. (2008). Which kind of collaboration is right for you? Harvard Business Review, 86(12), 78-86.

Rahman, N., & Korn, H. J. (2014). Alliance longevity: Examining relational and operational antecedents. Long Range Planning, 47, 245-261.

Rai, R. K. (2016). A co-opetition-based approach to value creation in interfirm alliances: Construction of a measure and examination of its psychometric properties. Journal of Management, 42, 1663-1699.

Rao, A., & Schmidt, S. M. (1998). A behavioural perspective on negotiating international alliances. Journal of International Business Studies, 29, 665-693.

Reuer, J. J., Klijn, E., & Lioukas, C. S. (2014). Board involvement in international joint ventures. Strategic Management Journal, 35, 1626-1644.

Schilke, O., & Goerzen, A. (2010). Alliance management capability: An investigation of the constructs and its measurement. Journal of Management, 36, 1192-1219.

Tjemkes, B., Vos, P., & Burgers, K. (2017). Strategic Alliance Management (2 ed.). London: Routledge.

Williamson, O. E. (1975). Markets and Hierarchies: Analysis and Antitrust Implications. New York: Free Press.

Please click/tap your browser ‘Back’ button to return to the location navigated from. Alternatively, click/tap the ‘Antique Keyboard’ graphic below to navigate to The Global Business Strategy Album page.

All content © Colin Edward Egan, 2022