19th April 2019

Outside Fortress Europe Excerpts

This Global Business Strategy Blog post is based upon unabridged excerpts from Chapter Five, Analysing Global Markets and the Intelligent Company, in Outside Fortress Europe: Strategies for the Global Market.

Context References

Economist. (2019, March 23rd). Briefing: European technology regulation. The Economist, 19-22.

Economist. (2019, April 20th). Briefing: Unicorns going to market. The Economist, 23-26.

Economist. (2019, April 20th). Charging ahead: Big carmakers are placing vast bets on battery power. The Economist, 61-63.

Economist. (2019, March 2nd). Conscious decoupling. The Economist, 57.

Economist. (2019, March 23rd). Drivers wanted: Ride-hailing apps try to burnish their image. The Economist, 61.

Economist. (2019, March 23rd). Europe takes on the tech giants: To understand the future of Silicon Valley, cross the Atlantic. The Economist, 11.

Economist. (2019, March 9th). Facebook’s third act: A new business model could make the company harder to break up. The Economist, 61.

Economist. (2019, March 9th). Going against the grain: Disruptive technologies may change the whisk(e)y industry. The Economist, 73-74.

Economist. (2019, April 20th). Herd instincts: The wave of very highly valued startups heading to market suggests that Silicon Valley needs to rethink its focus. The Economist, 23-26.

Economist. (2019, April 6th). Hotstarwars: Hollywood meets Bollywood as the global streaming wars reach India. The Economist, 61.

Economist. (2019, February 23rd). It takes a village: Why retired people could be ideal partners in self-driving cars. The Economist, 73.

Economist. (2019, March 9th). Luvvies leaving: HBO’s boss resigns, raising questions about WarnerMedia’s strategy for streaming. The Economist, 59.

Economist. (2019, March 23rd). The power of privacy: The strong positions European regulators take on competition and privacy are reinforcing each other. That should worry American tech giants. The Economist, 19-22.

Economist. (2019, March 23rd). See you in court: three challenges to the way that the internet traffics in attention. The Economist, 22.

Economist. (2019, March 30th). Streamlined: A wave of consolidation pits Disney, AT&T and Comcast against Netflix, Amazon and Apple. Billions are being torched. Someone will get hurt. The Economist, 66-67.

Economist. (2019, April 20th). The trouble with tech unicorns: Millions of users, cool brands and charismatic bosses. Tech’s latest stars have everything – except a path to high profits. The Economist, 13.

Economist. (2019, March 30th). The ultimate coffee machine: Inhumanly good service coming soon to a café near you. The Economist, 81.

Economist. (2019, March 9th). Unicorns in winter: A formerly white-hot sector is finding it harder to attract venture capital and is shedding employees. The Economist, 58-59.

Economist. (2019, April 6th). Yearning to be touched: An online reding room wants to get into the printing business. Economist, 61.

Wolf, M. (2019, 17 April). China wrestles the US in the AI arms race: What counts is implementation of the technology not innovation, and here Beijing has big advantages. Financial Times, p. 11.

Outside Fortress Europe Excerpt

The product life cycle and its dynamics

In the literature associated with marketing and product management the product life cycle (PLC) is a concept that suggests that, like natural species, products follow a typical pattern, progressing from conception, through launch into the world (often with complications), rapid growth, slowing growth towards maturity and onwards to the ‘inevitable’: death.

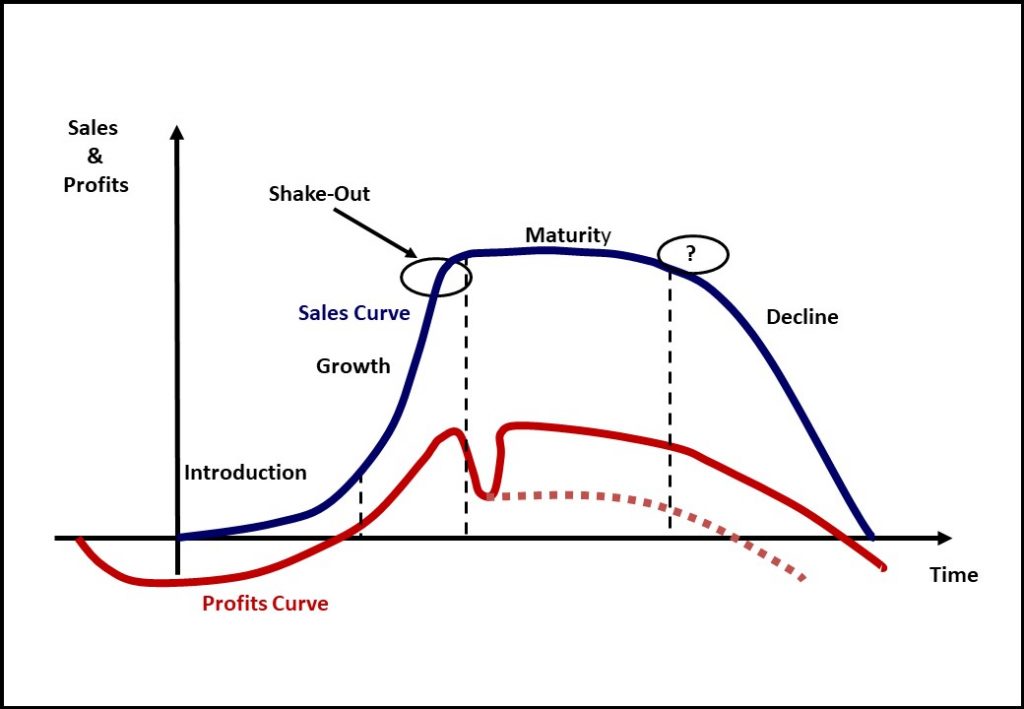

The PLC is often taught (and used) as a planning tool but, although there is a degree of predictability regarding its discrete phases, there are multiple complicating factors that make it difficult for any individual firm to fully control or even influence it. A generalised schematic of a ‘typical’ PLC is shown in Figure 1.

It should be noted that the dynamic of the PLC is a dependent variable, i.e. its shape and lifespan are a function of independent decisions taken by many firms, each interpreting the same business environment through a different lens and with disparate objectives. Product categories are typically associated with specific process technologies and these are typically supplied by industries made up of similar firms. It is overly simplistic to suggest that products are associated with identified customer needs, but this can be complicated for suppliers when the fundamental needs remain or grow but customer preferences for fulfilling them change. A detailed real-world example here – the displacement of photographic film and the laboratory processing of pictures – should clarify the issues ahead of a more detailed assessment of the realities of the PLC and its implications for suppliers:

-

-

- Customer need: to capture images.

- Product solution: one-off purchase of traditional camera and repeat purchase of photographic film.

- Process solution: camera manufacture and chemical engineering for film (picture) processing.

- Supply base: camera manufacturers (e.g. Canon); photographic film producers, e.g. Kodak, Fuji, Agfa (all of which also sold cameras in one way or another, either manufactured in-house or outsourced and branded); independent film processor laboratories, e.g. Boots the chemist, professional studios.

- Photographic film brand communications: Fast Moving Consumer Goods (FMCG) style, e.g. ‘You press the button, we do the rest’ (Kodak).

- Distribution: intensive; multiple outlets, including pharmacies, tabacs, 7-Eleven stores, large-chain multiple outlet retailers, ranging from purveyors of mainstream groceries to consumer electronics.

-

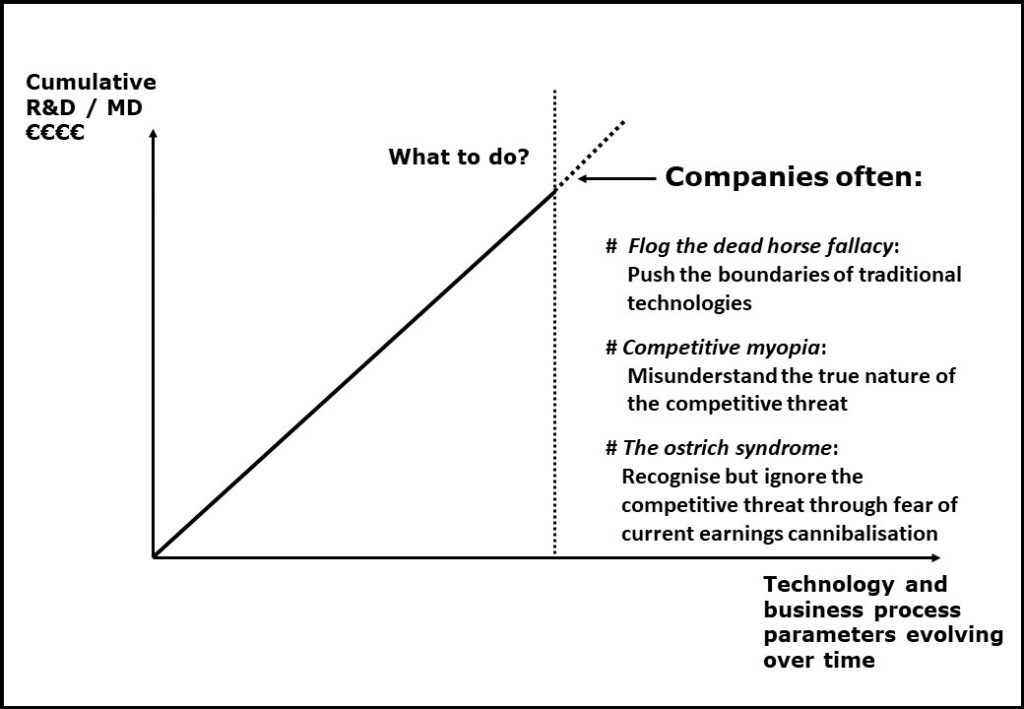

Collectively these can be described as technology and business process parameters that bring a product/service from raw materials to ultimate consumption. Figure 2 depicts these on the horizontal axis of the graphic illustration it presents. The vertical access represents cumulative R&D and Market Development (MD) investments, the latter including brand building (‘Route to Mind’), channels development (‘Route to Market’), channel management, business partnering, etc., i.e. it portrays the ongoing costs of conducting business competitively.

With the advent of digital photography, the customer need (capturing images) remained the same, the traditional product solution, photographic film, predictably died and the market leader, Kodak, misread the threat and made three very typical errors associated with what Harvard Business School Professor Clayton M. Christensen described as The Innovator’s Dilemma (Christensen, 1997), a notion which begs the question: what should long-established market leaders do when a new technology is emerging which potentially undermines a fundamental business model that has sustained a market position for decades, and even longer in some cases, as in our example, photographic film? While he did address the critique of having identified a problem without explaining it from an organizational perspective in a sequel to the original, The Innovator’s Solution (2003), there remained an excessive focus on the supply side, for example ‘product’ and ‘technology’, at the expense of acknowledging the key force underpinning the marketing process: consumer choice.

In this chapter and the next (Strategic Marketing and Global Brand Management), we address the issue of ‘disruption’ from a perspective that views the behaviour of buyers and their motivations when making purchasing decisions as the key driver of the innovation process.

Returning to the issue of how established or ‘incumbent’ companies address potential threats to their existing business models and market positions, we can identify three common strategic errors associated with disruptive technology ‘tipping points’ (discussed in the next section). Figure 2 graphically summarises the discussion thus far.

The strategic and organizational challenges are complex and interwoven, but it is possible to identify three ‘generic’ mistakes which established market leaders often make when confronted with disruptive technologies and/or business processes.

(The analyses of disruptive technologies and ‘tipping points’ which follow are this author’s interpretations based upon an extensive review of the literature relating to innovation and his consultancy work with technology leaders such as Philips, IBM, Reed Elsevier and Castrol over many years, a period which has featured multiple disruptions and several tipping points in many of the market sectors these companies compete in).

The following strategic innovation errors are commonly witnessed, especially amongst established market leaders but often in entire industries when disruptive technologies and/or business processes emerge.

Error One: Flogging-a-dead-horse fallacy, the belief that, despite all the available evidence to the contrary, further investment in developing the product/process technology and/or business processes (e.g., distribution) will reap dividends. As John Maynard Keynes observed from a broader economics perspective, “The difficulty lies not in the new ideas, but in escaping from the old ones”.

Error Two: Competitive myopia, misperceptions relating to the true nature of the competitive threat, especially common when oligopolistic market structures are attacked by industry outsiders.

Error Three: The ostrich syndrome, recognising the competitive threat but ignoring it for fear of compromising current revenue streams (the threat of earnings cannibalisation).

Underpinning these errors is that billions may have been invested in cumulative R&D, pushing the boundaries of existing technologies to their natural limits. It is difficult for companies to ‘write off’ such investments even though, by normal statutory accounting processes, they have already been ‘accounted for’ on an annual basis.

As previously noted, these investments are illustrated in Figure 2 on the vertical axis as cumulative R&D (Research & Development) and MD (Market Development). The upward-sloping line is a graphical rather than a statistical illustration and the word cumulative is a proxy for time, which also features on the horizontal axis. The meaning of Figure 2 can be understood as follows: over time, cumulative investments are made in technology and business processes and, at a certain point in time (indicated by the vertical dashed line), disruptive solutions threaten a long-established business model.

Great market leaders will continue to develop their core technologies and business processes over time to ensure that they are always one step ahead of the competition, an approach which Professor George Day describes as “the discipline of market leadership”. Citing Procter & Gamble (P&G) as an exemplar, he makes the following observation relating to the world-class FMCG company (Day 2014):

Few companies dare attack P&G in their core markets. With a long history of aggressive retaliation and clear signals as to how they will react in the future, P&G keeps underlining their total commitment to the protection of their share position.

Figure 3 provides a single case example of a P&G brand category killer, Fairy Liquid hand-wash ‘dirty dishes’ detergent (branded Dreft outside of the UK). The company created this category well over a century ago and have maintained leadership of it ever since. Looking again to Day’s quote, the keyword is commitment, reflecting a policy pledge in the company’s ultra-secret brand bible – which the author has seen, inadvertently, but legally (see the discussion below relating to knowledge acquisition, integrity and governance) – to defend to the hilt their category leadership positions.

This simple example is replicated in multiple case scenarios by P&G worldwide, ranging from Pringles crisps to Vick’s vapour rubs and nasal sprays to Gillette shaving systems. All too frequently, however, market leaders concede their dominant positions, often meekly, through a combination of factors in a spectrum spanning complacency and arrogance (e.g. IBM and Philips in the early 1990s), myopia (e.g. Intel’s early withdrawal from 5G technology investment and its failure to see the emerging smartphone revolution) to simple corporate stupidity (e.g. Nokia, Blackberry), and often from what some organizational theorists describe as ‘success-induced-incaution’.

Consider the following quote from the late Nicolas Hayek, former Chairman and CEO of SMH (now The Swatch Group), the Swiss watch company which owns brands including Blancpain, Longines, Omega, Rado, Tissot and the best-in-class example of ‘mass customisation’, Swatch:

The seeds of failure lie in success itself. We must be energetic and tireless, and everyday fight against the beginnings of arrogance towards our customers. We must also be energetic and tireless against any tendency to become presumptuous, to rest on our laurels or fall back into old habits. This would be deadly for the enterprise.

These were comments made in a speech to shareholders when announcing the company’s outstanding annual results in 1992 and ahead of the company going from strength to strength thereafter and onwards to the present day (the company’s current CEO is Hayek’s son, Nick Jr.).

SMH was founded as a direct result of the most frequently cited textbook example of the potentially devastating impact of disruptive technology, the collapse of the entire Swiss watch industry. All the major Swiss firms persevered with cumulative R&D investments in precision engineering while ‘new’ (i.e. previously unknown) Japanese entrants Seiko and Citizen took the global market by leveraging the relatively inexpensive but accurate time-keeping properties of quartz, a ‘technology’ which was discovered by the Swiss and largely ignored by its global market-leading watchmakers.

Reverting to the Kodak example, the company classically made the three strategic errors illustrated in Figure 2.

First, flogging the dead horse: Kodak invested huge amounts in pushing the boundaries of what was achievable in photographic film, developing a technology they called Advanced Photo System (APS) which offered very few additional benefits for the consumer, the most notable being the ability to take pictures in landscape or ‘panoramic’ modes and the ability to remove the new cartridge system without exposing the film. The consumer was also ‘rewarded’ with one extra image per cartridge which could, of course, be as disastrous a composition as the rest – you would still have to wait 24 hours to find out!

Second, competitive myopia: they didn’t realise that the competition for cash flows came from inkjet cartridges, not other photographic-film makers and processors and definitely not from consumer electronics companies and their digital cameras. Consumers were steadfastly unimpressed with APS and unwilling to pay the price premiums being demanded for it.

(Kodak had created the first-ever ‘digital’ camera in 1975 but deemed it a ‘toy’ and irrelevant. With an irony that couldn’t be crafted in fiction, Kodak’s nemesis, Apple, launched the world’s first mainstream consumer digital camera in 1994. It was named the QuickTake and, with a hint of contract manufacturing strategies to come (iPhone/Foxconn), Apple outsourced the manufacture of its new gadget. To Kodak).

Third, the ostrich syndrome: the ultimate failure of Kodak was rooted in internal organizational politics and the fear of cannibalising the company’s cash cow, photographic film. As journalist David Usborne noted in The Independent newspaper when reporting on Kodak’s filing for Chapter 11 bankruptcy on 19th January 2012, “The world’s biggest film company filed for bankruptcy yesterday, beaten by the digital revolution. The only problem is, the enemy started within” (Usborne, 2012, January 20th). As the nineteenth-century French poet Victor Hugo observed, “You can resist an invading army, but not an idea whose time has come”.

It should be acknowledged here that both Fuji and Agfa joined in the APS development as the three market leaders scrambled to create a new industry standard. But the industry was dead, kaput, finished. The product category that fed its factories and consumed its chemicals was no longer desired or purchased. And everybody on the ‘outside’ knew it. HP exploited it: people still wanted hard copies of digital images and HP was happy to oblige with their Photosmart® inkjet printers. The key difference between the three film companies in dealing with this disruptive technology was that Fuji and Agfa were much more broadly diversified than Kodak and therefore the single product failure – APS – didn’t significantly impact their corporate futures.

The realities of the product life cycle

The title of this section pays tribute to one of the world’s leading authorities on marketing and strategic management, the late Professor Peter Doyle, who challenged the over-simplification in the usage of the product life cycle (PLC) concept in practice, even though its theoretical roots in economics were technically robust (Doyle, 1976).

The various stages of the PLC (introduction/growth/maturity/decline) were mentioned above. The list below presents a number of generalised ‘truths’ relating to the PLC as presented in Figure 1:

-

-

- Markets invariably alter over time.

- Growth happens as market segments adopt new products and services.

- The rate of growth slows and eventually ends, leading to a period of maturity often described (incorrectly) as ‘market saturation’, e.g. 95% of EU households currently own a flatscreen television, regardless of the technology behind it.

- Competitive rivalry changes over time (discussed further below).

- Cash flows change through the life cycle.

- Profits change through the life cycle.

- Decline occurs.

- Death occurs.

-

Taken together, these ‘market-facts-of-life’ present the following strategic marketing implications:

-

-

- Company alertness and business environment sensitivity are paramount and business mission critical.

- Strategic clarity and operational excellence should be dynamic and flexible through the product life cycle.

- Marketing mix adaptation through the profit life cycle is essential.

- Complacency is irresponsible.

- Quantitative and qualitative forecasting is vital.

- Contingency strategies and plans must be made.

- A balanced portfolio must be achieved.

-

A detailed discussion of these PLC truisms is beyond the scope of this section which, as we will see below, has its focus on a more substantive concept, the Market Life Cycle (MLC).

Disruptive business models and tipping points

One of the greatest challenges in using the PLC as a strategic planning tool is barriers to accurate forecasting, not least because, in the absence of industrial espionage, the product or business development manager mapping his or her product management roadmap has no idea what their counterpart in a rival firm, looking at the same market data, is planning to do. Also, it’s a remarkable oversight in many marketing textbooks and teaching situations not to emphasise that the product life cycle is a demand construct: its (i) shape (ii) form and (iii) longevity are based upon products bought by consumers with hard cash (or credit card), i.e. all three factors reflect real-world buyer behaviour, what economists define as effective demand (goods purchased).

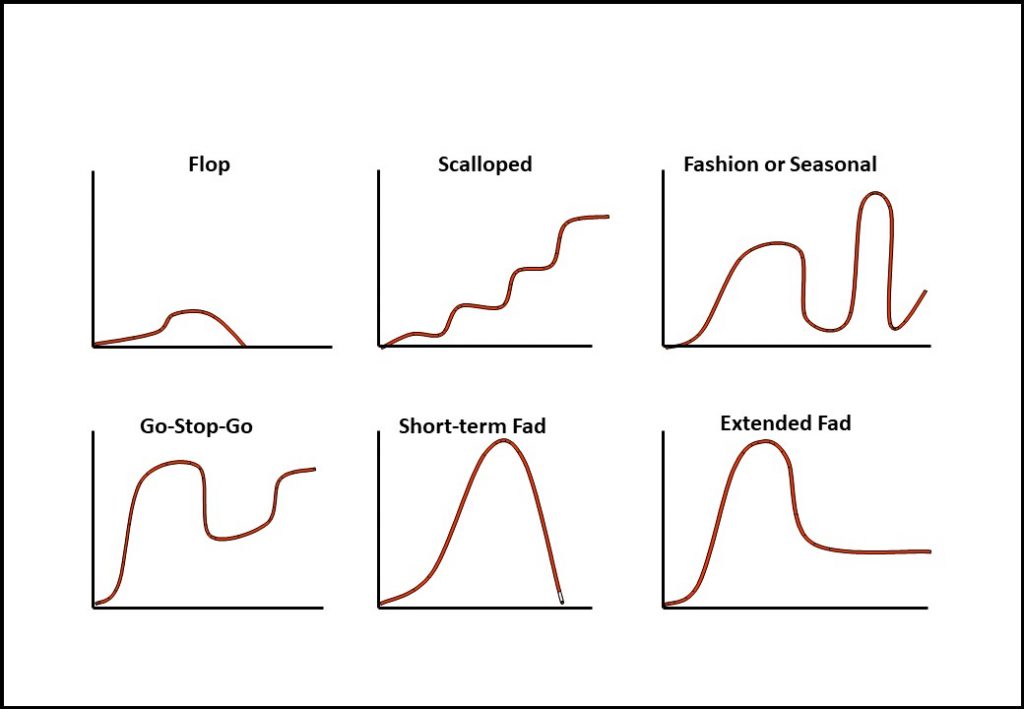

Furthermore, with reference to consumer behaviour, as the poet and cultural icon Jim Morrison (the Doors) reliably informed us, People are Strange, and their behaviours can be wildly unpredictable (see Chapter Six for insights). Another PLC problem is that, rather than the neat-and-tidy generalised form shown in Figure 1, real-world product life cycles have numerous shapes and erratic profiles. Figure 4 provides a sample.

It’s possible to have great fun with managers when discussing this diversity of recognisable PLC types but here is not the place for frivolity. Seriously, the fact that this is only a sample of an immeasurable number of possibilities indicates that:

-

-

- It is extremely difficult to predict turning points between PLC life-stages.

- It is hard to recognise what is going on during a turning point; for example, is the product-market going through a period of short term volatility with upside potential or is it genuinely on the wane (hence the question mark in Figure 1 at the late maturity phase of the PLC).

-

Because of the two factors mentioned above, there are a number of recognised errors in the application of the PLC, especially as a planning tool:

-

-

- Anticipating and/or accepting a pre-destined shape.

- Ignoring marketing effects, i.e. the different decisions companies make when looking at the same category revenue data.

- Ignoring business environment effects, e.g., deregulation (which can be anticipated) or extreme weather conditions (less so).

- Ignoring needs, preferences and product aggregation factors and the influence of these on product life-cycle longevity.

-

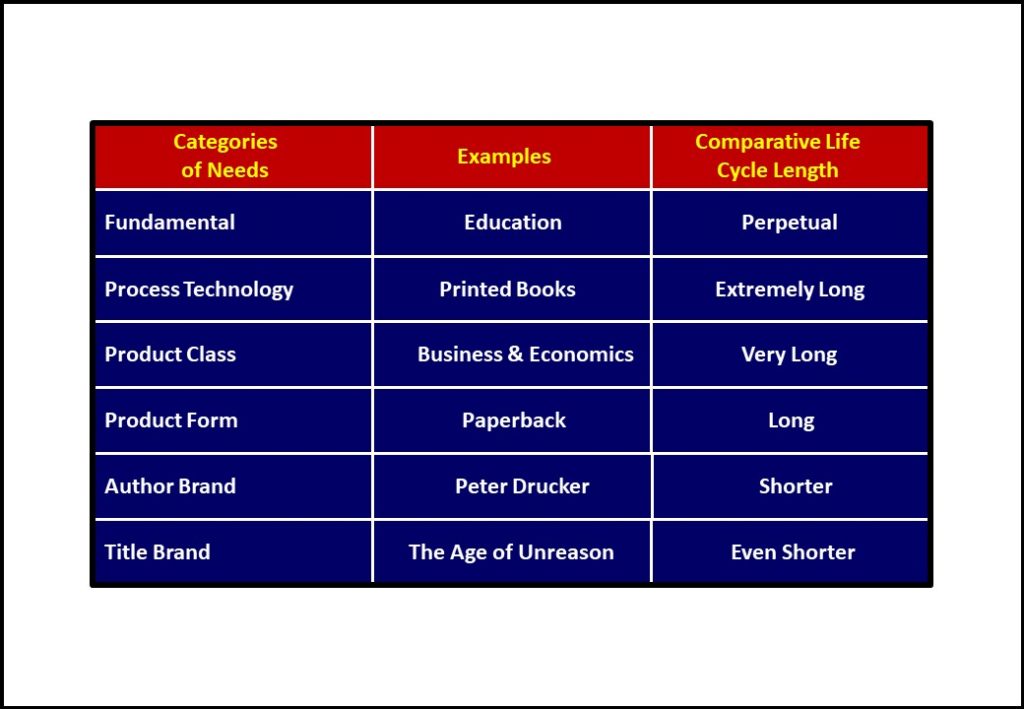

This last point in the list above is a complex area of PLC theory and we address it in the next section. Ahead of that discussion, Figure 5 sheds some light on the key issues which need to be understood. The graphic should be read on a row-by-row basis, top-to-bottom, left-to-right. The second and third Columns (examples and life cycle longevity) are a function of the category of needs represented in the first Column. In this example, the fundamental need is Education and the product category analysed is books.

If we now consider the scenario represented by the question mark in the PLC depicted in Figure 1, we can briefly discuss the challenge of dealing with disruptive solutions to the Fundamental Needs category identified in Figure 5. While the customer needs continue in perpetuity, their preferences for alternative solutions to fulfilling them will be the key driver of market outcomes and will determine which firms thrive and which flounder.

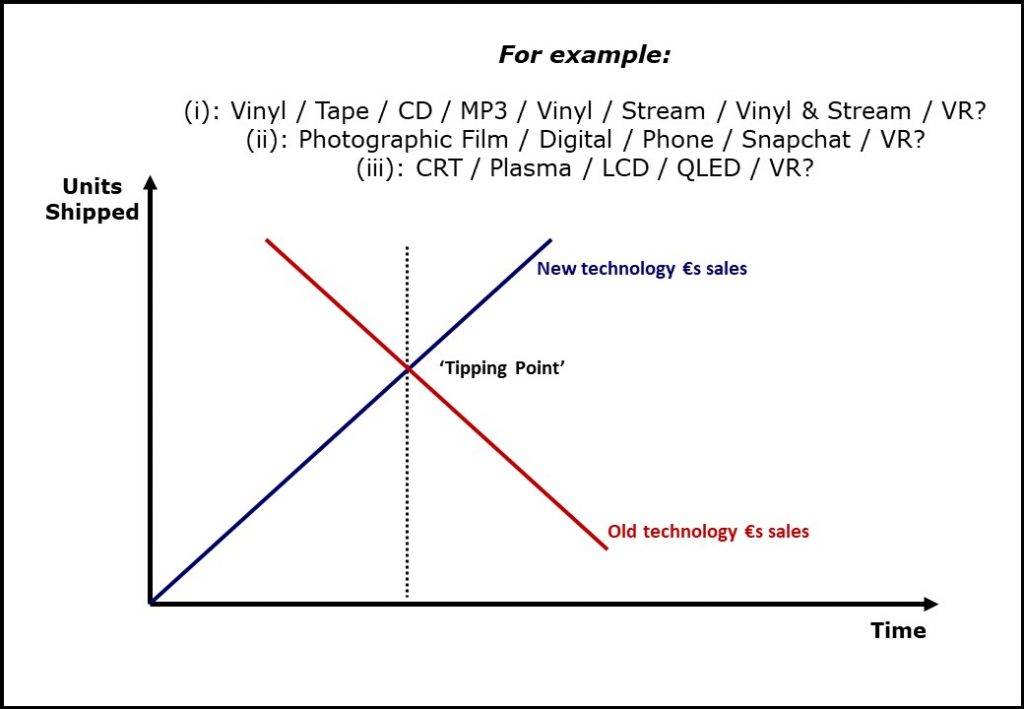

Figure 6 presents a graphic illustration of disruptive technologies and an idea that has captured the imagination of management academics and business consultants, an audience way beyond the original target reader which the author wrote for: Tipping Points. (See Gladwell, 2002, for the original idea and its many applications).

Where death occurs but needs continue: Customer preference is sovereign

Figure 6 depicts a deliberate simplification of what is quite clearly a complex phenomenon. Fundamentally, we need to acknowledge that this data represents a supply-side metric: Units shipped (depicted on the vertical axis). But we should also note that this data is a function of a demand-side phenomenon: consumer choice. It is worth taking time here to briefly note four key dimensions of buyer behaviour that drive the marketing process:

-

- Buyer Behaviour: This describes how and why and when and where consumers and organizations behave in the way they do when making purchase decisions. Major contributions to the marketing literature from psychology (consumer buyer behaviour) and sociology (organizational buyer behaviour) have provided deep insights into the motivations and behaviours underpinning the purchasing process (see the ‘Recommended resources for further inquiry’ section below for relevant textbooks relating to this important dimension of marketing management).

- Customer Needs: These are those elements of buyer behaviour that describe fundamental requirements underpinning a purchase decision, e.g. a need for transportation.

- Customer Preferences: it is essential to distinguish these from customer needs, which relate to generic categories such as leisure, transportation, photography etc. So, there is a need for transportation but customers express preferences for different transportation modes, e.g. road (car or bus), rail, air, sea etc.

- Customer Supplier Selection: to continue with the transportation example, having selected, say, travel by air, this buyer behaviour category relates to which supplier is selected to provide the service, e.g., for a trip from London to New York, the customer can choose between British Airways, Virgin Atlantic, Delta, American Airlines etc. This is the level of buyer behaviour that provides the front-line battleground of direct competition between rival companies and brands.

We explore these categories from a strategic marketing and global brand management perspective in detail throughout Chapter Six, Strategic Marketing and Global Brand Management. We use them here to develop our discussion of life-cycle theories. Simply stated, the single most important driver of life cycles of all types is customer preference, not products, technologies or business processes. So, for example, it is changed customer preferences which determine the stages and length of PLCs, although we absolutely acknowledge that suppliers can and do influence this: it was hippy-icon Steve Jobs and Apple who killed off the traditional cell phone by making available the sleek new smartphone, the iPhone, killing off more than one industry in the process. As we will see, this requires that suppliers create new needs which the customer may not be aware they have. As Henry Ford famously observed: “If I’d asked customers what they wanted, they would have told me a faster horse”.

Reverting to Figure 4, and focusing on the consumer market, three broad product categories are presented, each of which represents a particular ‘fundamental need’ category: ‘leisure and entertainment’. Five observations should suffice to explain what we choose to describe here as the Customer Preference Life Cycle:

-

- All three product categories span more than 50 years in existence: (i) audio entertainment, consumed privately (e.g. iPod/iPhone) or with friends (e.g. teenage bedroom/college dorm/’pop-up’ parties); (ii) capturing memories (again, home-based, not professional): ‘a Kodak Moment’; (iii) televisual (home-based) entertainment.

- With the exception of one ultra-nerdy (tiny) sub-segment in the first category, none of the consumers: (a) care about the technology; (b) care for the suppliers who supply it (over and above their own brand preference, which is important); (c) have absolutely no concern as to whether these suppliers make any money out of the pleasures they provide them with.

- ‘Quality’ is a multi-dimensional construct. For example, in (i), the audio category, MP3 technology was in no way superior to CD in terms of sound quality; rather, it gave consumers more direct choice over how they enjoyed their music, along with many more tracks to play and greater flexibility in what sequence to play them (playlist). This was never a battle between analogue and digital (who cares?); it was between linear versus shuffle, customer choice over supplier technology constraint. As a brief aside, Apple’s genius in simply renaming ‘random’ – typical on CD players – to ‘shuffle’ on their iPods reflected the widely known customer complaint that pressing the random play button on a Sony CD Walkman (aka Discman) would often play the same tune twice. Which, of course, it would, just as rolling a dice twice consecutively will occasionally turn up a six in two straight throws, which could be good news or bad depending on the game being played. It is interesting to note from Figure 4 that Vinyl appears to be making a comeback and sales are growing rapidly (up 25% in the UK in 2017), albeit from a very small base. Almost certainly this represents multi-faceted buyer-behaviour motivations and, therefore, different market segments, including (a) baby-boomer nostalgists seeking juke-box happy-days memories; (b) collectors and instinctive hoarders; (c) audiophiles and their love of crackles; (d) hipster coolness, the all-new yuppies. Or Netflix box-set addicts watching Suits and Harvey Specter-worshipping. Or, whatever: understanding such consumer motivations and tapping into them will determine supplier success with regard to disruptive technologies and business processes.

- Note that VR? appears in each of the three categories and could potentially displace all the current established technologies. Who knows (hence the question mark), but this has happened relatively recently, the scenario wherein one technology transformed multiple industries ranging from retail to high capacity hi-tech optical data storage: DVD.

- As an ultimate irony with reference to our Kodak story, the upstart start-up Snap Inc., a software company, in its 2018 IPO prospectus officially proclaimed itself to be a ‘camera company’. You couldn’t make this novella up. Or you could, but no one would buy it.

Now that we’ve established some core principles of life cycle theory it is time to apply them to real-world global business strategy scenarios, the prime objective being to examine their nature and characteristics and, more importantly (given the objectives of this book), to consider the strategic implications and organizational challenges these market ‘facts-of-life’ pose for companies seeking to exploit the opportunities they present and/or to off-set the demons they threaten.

Recommended resources for further inquiry

For further insights into the topics discussed in this post, particularly (i) innovation and (ii) market segmentation, please see the earlier Global Business Strategy Album posts below.

(i) What would Steve say? Has Apple become a follower, not a pioneer?

(ii) Millennials are so passé. And irrelevant for global marketing strategy design…

For readers interested in a more detailed exploration of the subject of consumer buyer behaviour and its implications for marketing professionals, this author’s recommended textbook, based upon the multiple criteria presented in the ‘Introduction to the Global Business Strategy Blog’ and extracted here is: Soloman et al., (2016): Consumer Behaviour: A European Perspective.

For readers interested in a more detailed exploration of the subject of organizational buyer behaviour and its implications for marketing professionals, the author’s recommended textbook, based upon the same criteria, is Hutt and Speh, (2012): Business Marketing Management B2B.

For an update on a classic book on the subject of innovation adoption, see Geoffrey Moore (2014), Crossing the Chasm: Marketing and Selling Disruptive Products to Mainstream Markets. This text primarily focuses on ‘technology transfer’ from hi-end, hi-tech B2B niche markets into mainstream consumer markets and it builds upon the seminal work of Everett Rogers, (2003), The Diffusion of Innovations.

Outside Fortress Europe Excerpt References

Christensen, C. M. (1997). The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail. Boston, MA: Harvard Business School Press.

Christensen, C. M., & Raynor, M. E. (2003). The Innovator’s Solution: Creating and Sustaining Successful Growth. Boston, MA: Harvard Business School Press.

Day, G. S. (2014). Market Driven Strategy: Processes for Creating Value. New York: Free Press.

Doyle, P. (1976). The realities of the product life cycle. Quarterly Review of Marketing, 1(Summer), 1-6.

Gladwell, M. (2002). The Tipping Point: How Little Things Can Make a Big Difference (New edition ed.). London: Abacus.

Hutt, M. D., & Speh, T. W. (2012). Business Marketing Management B2B (11 ed.). Mason, OH: Cengage Learning.

Moore, G. A. (2014). Crossing the Chasm: Marketing and Selling Disruptive Products to Mainstream Customers (3 ed.). London: HarperBusiness.

Rogers, E. (2003). The Diffusion of Innovations (5 ed.). New York: Free Press.

Soloman, M. R., Bamossy, G., Askegaard, S., & Hogg, M., K. (2016). Consumer Behaviour: A European Perspective (6 ed.). Harlow: Pearson.

Usborne, D. (2012, January 20th). The moment it all went wrong for Kodak. The Independent, p. 28.

Please click/tap your browser ‘Back’ button to return to the location navigated from. Alternatively, click/tap the ‘Antique Keyboard’ graphic below to navigate to The Global Business Strategy Album page.

All content © Colin Edward Egan, 2022