1st March 2019

Outside Fortress Europe Excerpt

This inaugural foundation Global Business Strategy Blog essay is based upon excerpts from Chapter Ten, Theories of Organizational Behaviour and Strategic Management, in Outside Fortress Europe: Strategies for the Global Market.

In Chapter Eight, Implementing Global Business Strategy, we provide a detailed process for scanning and sensing the global business environment alongside providing frameworks for organizational capability assessment and undertaking an implementation audit.

Outside Fortress Europe Excerpt

Introduction

Risk and uncertainty permeate all functional aspects of corporate activities and they share a direct relationship with the dynamic nature of the global business environment. The developing pace of such environmental change along with the increasing size and complexity of the contemporary organization has given a high profile to the importance of accounting for risk amongst senior management, particularly in the strategic area of corporate planning. Here it has been recognised that large, diversified (or diversifying) companies must understand the complexities involved in securing ‘strategic fit’, i.e. the specific relationship between the firm and its environment which facilitates the successful achievement of company and business unit objectives.

Probabilities, possibilities and uncertainties

As the causes and effects of risk and uncertainty have become more significant to basic corporate objectives such as sales, growth and profitability, so ever more complex models have been advanced for their analysis. Many such models have proved hopelessly inadequate, especially as their sophisticated mathematics have been found to be extraordinarily difficult to apply in practice. Despite this, and as we demonstrate in Chapter Five of Outside Fortress Europe, ‘Analysing Global Markets and the Intelligent Company’, the challenge of knowledge acquisition remains one of fundamental importance if sensible strategies are to be created and implemented.

Professor Igor Ansoff, widely regarded as the ‘founding father’ of the discipline of strategic management and whose seminal contribution to the discipline we introduced in Chapter Five, describes conditions of risk as the situation where alternatives are known and so are their probabilities; in contrast, conditions of uncertainty are those situations where alternatives are known but not their probabilities. Under conditions of risk and uncertainty, according to Ansoff, “the consequences of different alternatives can be analysed in advance and decisions made contingent on their occurrence”. The means of achieving these contingent decisions is strategy, a process he describes simply as “a rule for making decisions”. In this fundamental sense, strategies involve, at the most senior level, decisions regarding diversification and internationalization of operations. Before such major decisions are made, however, other sophisticated analyses must take place within a company, often based on the forecasting of future events and the delineation of organizational activities, capabilities, competencies and business processes (see Chapter Eight, Implementing Global Business Strategy, for details and insights).

In analysing the impact of risk and uncertainty, then, firms should consider a variety of possible outcomes and subsequently take a view as to the relative likelihood of their occurrence and whether they would be favourable (opportunity) or detrimental (threat) to the company. A process of business environment scanning would have as its starting point an overview of factors influencing the company at the time of a ‘strategic audit’ alongside a consideration of key business environment trends and discontinuities (more of which later). At the most senior levels of management within an organization, risk is dealt with by decisions that are taken in the direction of corporate strategy (though there are some tricky definitional problems).

The full complexities of risk analysis at this level are beyond the scope of this chapter but it is worth mentioning here the unique challenges of risk assessment relating to corporate decisions to diversify or globalize their business, a common strategic move amongst large or fast-growing organizations. Prof. Ansoff points to two key problems within the practice of risk assessment:

-

-

- There is a need to recognise at the outset that the ability to see the future in any detail is limited to only certain foreseeable events.

-

-

-

- There is every reason to expect that other events, unforeseeable at present, have a high likelihood of occurring in an uncertain future, elsewhere described elegantly by Nassim Nicolas Taleb in his global bestseller The Black Swan: The Impact of the Highly Improbable. (In his new book, Skin in the Game: Hidden Asymmetries in Daily Life, Taleb explores randomness, a greater terror).

-

These factors, in turn, will affect the expectations derived from diversification or globalization initiatives, strategies whose prospects will be dependent upon three sources of uncertainty:

-

-

- Uncertainties in the estimation of results.

-

-

-

- Uncertainties in projecting the dynamics of the current business environment into the future.

-

-

-

- Uncertainties in anticipating competitive reactions, particularly in turbulent times (see Chapter Five, Analysing Global Markets and the Intelligent Company, for insights relating to ‘The Competitor Intelligence Process’).

-

It is extremely difficult to resist citing former US Defence Secretary Donald Rumsfeld’s cerebral observations on the nature of uncertainty here, so we won’t:

There are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also ‘known unknowns’ – the ones we don’t know we don’t know. And if one looks throughout the history of our country and other free countries, it is the latter category that tend to be the difficult ones.

Restoring some sense of normalcy, we can observe that Ansoff has usefully drawn together the implications of risk and uncertainty for decision making at the strategic level, indicating the importance of forecasting the variables which affect the business environment as well as highlighting the inherent difficulties of such predictive techniques. Of noteworthy relevance here is to understand what he describes as the “degree of changeability” in the business environment which, he argues, can be understood as levels of environmental turbulence. In attempting to quantify such turbulence, the mathematician in Ansoff has identified the following key factors which determine its force and impact:

-

-

- The changeability of the market environment.

- The speed of such change.

- The intensity of competition.

- The fertility of technology.

- The level of discrimination by customers.

- Pressures from governments and influence groups.

-

In his ground-breaking work on strategic management, Ansoff charted the history of environmental turbulence throughout the twentieth century and located its progressive growth amongst four key trends:

-

-

- Growth in the novelty of change, whereby past experience becomes less useful.

- A growth in the intensity of the environment, so that responsiveness to it absorbs a growing proportion of managerial resources.

- An increase in the speed of environmental change, a major driving force being the speed of technological innovation.

- The growing complexities of the business environment more generally.

-

Taken together, these key forces led to a model of the business environment which was characterised more by discontinuous change than the static and evolutionary nature of most environmental models in the available literature of the time. The recognition of revolutionary rather than evolutionary change was not a new phenomenon. In the broader context of the emerging post-industrial period, Peter Drucker had characterised the modern era as the ‘Age of Discontinuity’ and set in motion a theme that continued throughout the 1990s to the present day of disruptive technologies and business processes (see Chapter Five, Analysing Global Markets and the Intelligent Company, for details and case scenarios).

The importance of such environmental change and turbulence is not its existence per se; rather, it is the ability of companies to make appropriate responses. As Professor Charles Handy noted in an update to his classic study of an uncertain world, “discontinuous change requires discontinuous upside-down thinking to deal with it, even if both thinkers and thought appear absurd at first sight”. Discontinuity is similar in its meaning to Mitchell Waldrop’s complexity construct, a concept developed from the then-nascent discipline of chaos theory. Providing a ‘pure science’ perspective on social science phenomena, Mitchell Waldrop, a physicist, took as the driving force behind his thinking the trend in scientific investigation towards holistic views as a challenge to the orthodoxy of deconstructing science into smaller and smaller parts of the larger whole. His notion of complexity is founded upon the following questions:

Why is it that simple particles obeying simple rules will sometimes engage in the most astonishing, unpredictable behaviour? And why is it that simple particles will spontaneously organize themselves like stars, galaxies, snowflakes, and hurricanes – almost as if they were obeying a hidden yearning for organization and order?

Mitchell Waldrop went on to apply the complexity conundrum to economics. In a challenge to the equilibrium constructs of theoretical economists, he argued that such theories have shunned the reality of instability and change in the modern economy. Crystallising his ideas within the notion of increasing returns to contrast with the economic principle of diminishing returns, he argues that the complexity construct could help to “understand the messiness, the upheaval, and the spontaneous self-organization of the world.”

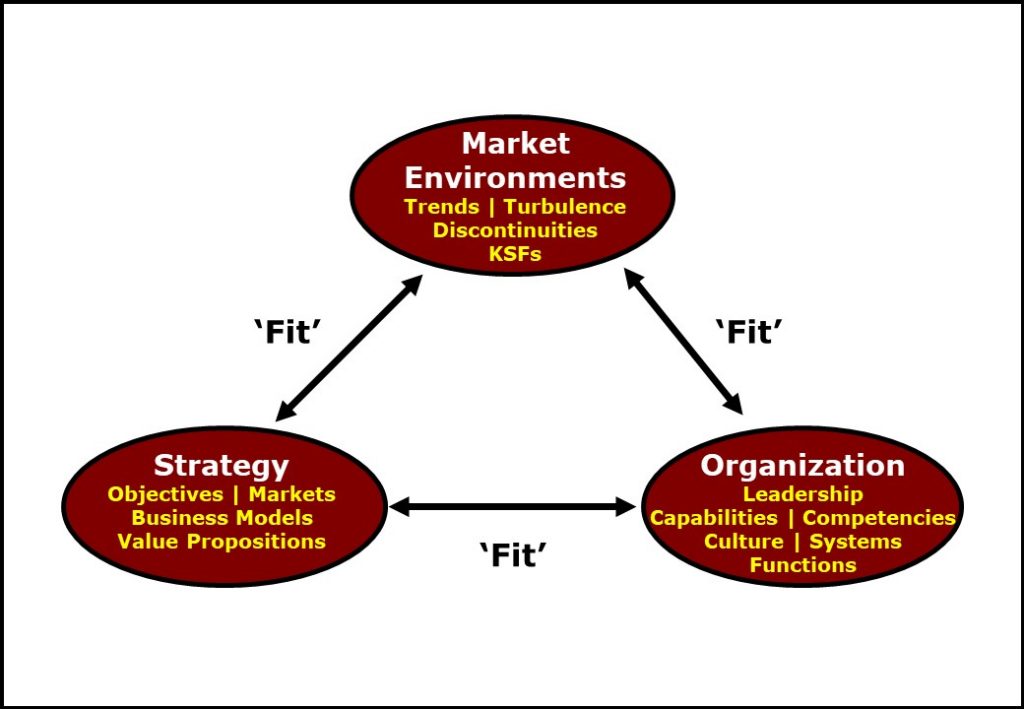

The concept of complexity embraces a flexible hierarchy controlled by the phenomena of evolution, adaptation and creativity. Emergence is seen as a behavioural construct in which, holistically, “groups of agents transcend themselves and become more.” The construct develops the concept of co-evolution, in which survival strategies and fitness are seen to be dependent on context and inter-dependency, a notion developed throughout Outside Fortress Europe and presented as the environment-strategy-organization nexus as depicted in Figure 1.

The previous sections have outlined the need for flexibility in organizational response to ensure ongoing success in turbulent business environments. This ‘survival of the fittest’ notion is powerful but does tend towards a reification (personification) of organizational form. At the end of the day ‘organization’ is an abstract concept; an organization is simply a collection of human and capital assets with a stated purpose. Remove this rationale and the organization will cease to exist. The challenge of organizational change, then, as Professor Peter Drucker has convincingly argued, is a challenge of management.

Concluding remarks

A variety of contemporary environmental factors have raised the importance of the change dimension as a significant factor impacting organizational survival. These, in turn, have led managers to re-evaluate the entire range of business processes and, more specifically, to seek ways of ‘re-engineering’ them. This managerial approach has had only varying degrees of success, with many transformational failures and organizational inertias trumping the flexible response required.

As Oxford University Associate Fellow Richard Tanner Pascale has convincingly argued, multiple tensions and conflicts must be attacked simultaneously as an organization ‘transforms’ itself through paradigm change in complex business environments:

With discontinuous change, leadership leaps into the unknown … the choices are abstract; their results cannot be predicted … Transformation is the managerial equivalent of Rubric’s cube. If you go left first and right second, you come out in a different place than if you had moved right first and left second.

Maybe Donald Rumsfeld had a valid point: see his excellent memoir, Known and Unknown, for further insights and fun.

Outside Fortress Europe Excerpt References

Ansoff, H. I. (1979). Strategic Management. London: McMillan Press.

Drucker, P. F. (1974). Management: Tasks, Responsibilities, Practices. London: Heinemann Professional Publishing.

Drucker, P. F. (1992). The Age of Discontinuity: Guidelines to our changing society (2 ed.). London: Transaction Publishers.

Handy, C. (2002). The Age of Unreason: New Thinking for a New World (2 ed.). London: Random House.

Mitchell Waldrop, M. (1992). Complexity: The Emerging Science at the Edge of Order and Chaos. Harmondsworth: Penguin.

Pascale, R. T. (1990). Managing on the Edge: How Successful Companies Use Conflict to Stay Ahead. London: Viking.

Rumsfeld, D. (2013). Known and Unknown: A Memoir. London: Penguin.

Taleb, N. N. (2007). The Black Swan: The Impact of the Highly Improbable. London: Penguin.

Taleb, N. N. (2018). Skin in the Game: Hidden Asymmetries in Daily Life. London: Allen Lane.

Please click/tap your browser ‘Back’ button to return to the location navigated from. Alternatively, click/tap the ‘Antique Keyboard’ graphic below to navigate to The Global Business Strategy Album page.

All content © Colin Edward Egan, 2022